Enhance Financial Stability With Aggressive GBP Administration Methods

In the realm of global company, the monitoring of GBP direct exposure is an essential element for ensuring monetary stability and mitigating prospective risks. These strategies are just the tip of the iceberg when it comes to GBP danger management.

Understanding GBP Exposure Risks

To effectively take care of financial security, it is essential to adequately recognize the integral dangers connected with GBP direct exposure. The British Extra Pound (GBP) is one of the most commonly traded currencies internationally, making it a crucial part of lots of investment portfolios and business deals. Nonetheless, GBP exposure features its very own collection of threats that can dramatically influence economic outcomes.

Another danger to think about is rates of interest fluctuations. The Bank of England's monetary plan choices can influence rates of interest in the UK, affecting the value of the GBP. Changes in passion prices can influence financial investment returns, borrowing expenses, and total economic performance for entities with GBP direct exposure. By evaluating and preparing for these organizations, individuals and threats can carry out reliable methods to alleviate possible losses and optimize financial stability when faced with GBP exposure obstacles.

Executing Dynamic Hedging Techniques

Provided the fundamental threats related to GBP exposure, a critical method to monetary stability entails the application of vibrant hedging techniques. Dynamic hedging is an aggressive risk monitoring method that adjusts the bush proportion on a regular basis based upon market conditions. google business profile management press release. By constantly monitoring and reflecting on the risk exposure, firms can adapt their hedging settings to reflect any adjustments in the GBP currency exchange rate, therefore mitigating potential losses

One secret aspect of vibrant hedging is using various economic instruments, such as futures and options contracts, to hedge against unfavorable currency movements. These tools offer adaptability and enable firms to react swiftly to market fluctuations. Additionally, vibrant hedging enables a more customized method to hedging, making certain that the protection lines up carefully with the certain risks encountered by the company.

Leveraging Money Options for Security

Purposefully leveraging currency alternatives can supply effective protection against GBP direct exposure threats in today's unstable market setting. Currency choices supply the owner the right, but not the obligation, to exchange a defined quantity of one currency for another at a fixed exchange rate before the option's expiration day. This adaptability enables organizations with GBP exposure to reduce prospective losses brought on by adverse exchange rate activities.

Utilizing Forward Agreements Tactically

When handling GBP direct exposure threats, integrating ahead agreements right Resources into your financial method can supply a proactive method to hedging versus adverse currency exchange rate movements. Forward contracts make it possible for companies to secure in a certain currency exchange rate for a future day, thus minimizing the uncertainty connected with rising and falling money values. By utilizing ahead agreements tactically, business can secure their profit margins, boost financial stability, and avoid prospective losses resulting from undesirable currency changes.

One trick advantage of making use of forward contracts is the ability to plan in advance with assurance regarding future cash flows in various currencies. This enables organizations to accurately anticipate their economic efficiency and make educated decisions without being revealed to the volatility of the forex market. Additionally, forward agreements give a degree of flexibility, as business can customize the contract terms to suit their details hedging requirements.

Surveillance and Adjusting Danger Monitoring Practices

Effective risk administration depends upon the continuous tracking and adaptation of established practices to line up with advancing market problems and interior dynamics. In the world of handling GBP direct exposure, staying vigilant to changes in currency values and adjusting risk administration approaches appropriately is extremely important. Consistently examining the performance of hedging mechanisms, such as alternatives and ahead contracts, is necessary to guarantee that they remain in accordance with the organization's danger resistance and financial goals.

Additionally, checking macroeconomic indicators, geopolitical occasions, and reserve bank policies that impact GBP currency exchange rate can give important understandings for refining risk management practices. By remaining notified about market trends and upcoming advancements, business can proactively change their threat mitigation approaches to capitalize and reduce potential losses on navigate to this site chances.

Along with outside variables, inner procedures and treatments must likewise be subject to visit continuous assessment. Carrying out routine testimonials of threat management frameworks and procedures can aid identify locations for enhancement and improve the general performance of GBP threat reduction strategies. By promoting a culture of versatility and continuous improvement, organizations can bolster their monetary security and durability when faced with money fluctuations and market uncertainties.

Verdict

Finally, positive monitoring of GBP direct exposure threats is necessary for boosting financial security. By implementing vibrant hedging methods, leveraging currency alternatives, utilizing ahead agreements purposefully, and continuously adapting and monitoring risk administration methods, companies can much better safeguard themselves from fluctuations in the GBP exchange price. It is critical for services to stay proactive and versatile in handling their currency risks to make certain lasting monetary stability and success.

In the realm of worldwide company, the administration of GBP exposure is an essential component for making certain financial stability and mitigating potential dangers. Political events, economic indications, and market supposition all add to the volatility of the GBP exchange rate, highlighting the requirement for a thorough understanding of these variables when managing GBP exposure.

When managing GBP direct exposure threats, including forward contracts into your monetary strategy can offer an aggressive method to hedging versus unfavorable exchange price movements. Carrying out routine reviews of threat management frameworks and methods can aid determine locations for renovation and enhance the overall performance of GBP threat reduction strategies.In final thought, proactive monitoring of GBP exposure threats is essential for enhancing economic security.

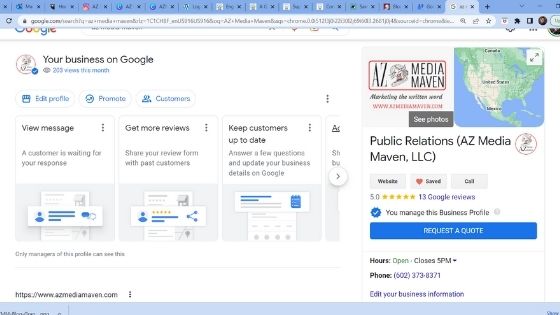

Comments on “Comprehensive Overview to LinkDaddy Google Business Profile Management Solutions”